ETF Monkey Personal Portfolio And Asset Location Update - Q4 2022

A difficult year ends with a solid 4th quarter.

Before I dive into the details I will present in this article, I’d like to quickly repeat the basics of what I shared in my portfolio update for the third quarter of 2022.

Combining Two Updates In One

Beginning with my portfolio update for the second quarter of 2022, in addition to reporting on my portfolio in total I broke everything out in terms of asset location. At the time, I wrote a two-part series of articles on the topic, as follows.

In the first article, I offered a theoretical framework for making asset location decisions. If you aren’t even sure what I am referencing by the term “asset location,” this is a great place to start.

In the second article, I followed up by revealing for the very first time the asset location decisions I have made in my personal portfolio.

Starting with the Q3 update, I combined all of this into one comprehensive article. Before we go any further, however, there is a key point readers need to understand. Here’s how I explained it in that second article.

Before now, I have never broken (my portfolio) out with respect to asset location. In this article, I will do so. However, to preserve at least a little privacy, I will disguise the actual amount I have in my portfolio.

Here’s how. I decided on $1 million as the amount to use for presentation purposes. I calculated the factor against which to multiply my total portfolio to arrive at an even million dollars. I then applied that factor against every component of my portfolio, such that all the relationships stayed the same.

In Q3, my portfolio experienced a decline of 4.69%, leaving me with a new factored amount of $953,148.48. I start from that point and present things on that same factored basis for this update.

Let’s get right into it then, shall we?

The Bottom Line

In my last personal portfolio update, I referred to Q3 2022 as “the quarter everything collapsed.” I led off with a tweet from Charlie Bilello featuring the fact that the classic 60/40 portfolio of U.S. stocks/bonds was down 21% YTD through Q3 2022, the second worst year in history (after 1931).

Happily, Q4 was a little better. Here’s a quick look at how the major US indexes have fared, showing both the Q4 and YTD changes.

During Q4, my portfolio managed a gain of 6.93%. Interestingly, a model portfolio I manage for the Hoya Capital Income Builder marketplace service on Seeking Alpha managed a gain of 7.98% over this same period. I’ll get into further detail with respect to some differences in the next section, but I am very happy with these results.

As featured in my Q2 portfolio update, I am not formally reporting on the entire first half due to some unique personal circumstances that make the comparison less than ideal. However, in the interests of full transparency, for the full year 2022, my portfolio declined by 11.21%.

With that, let’s get into the detail for Q4.

The Big Picture

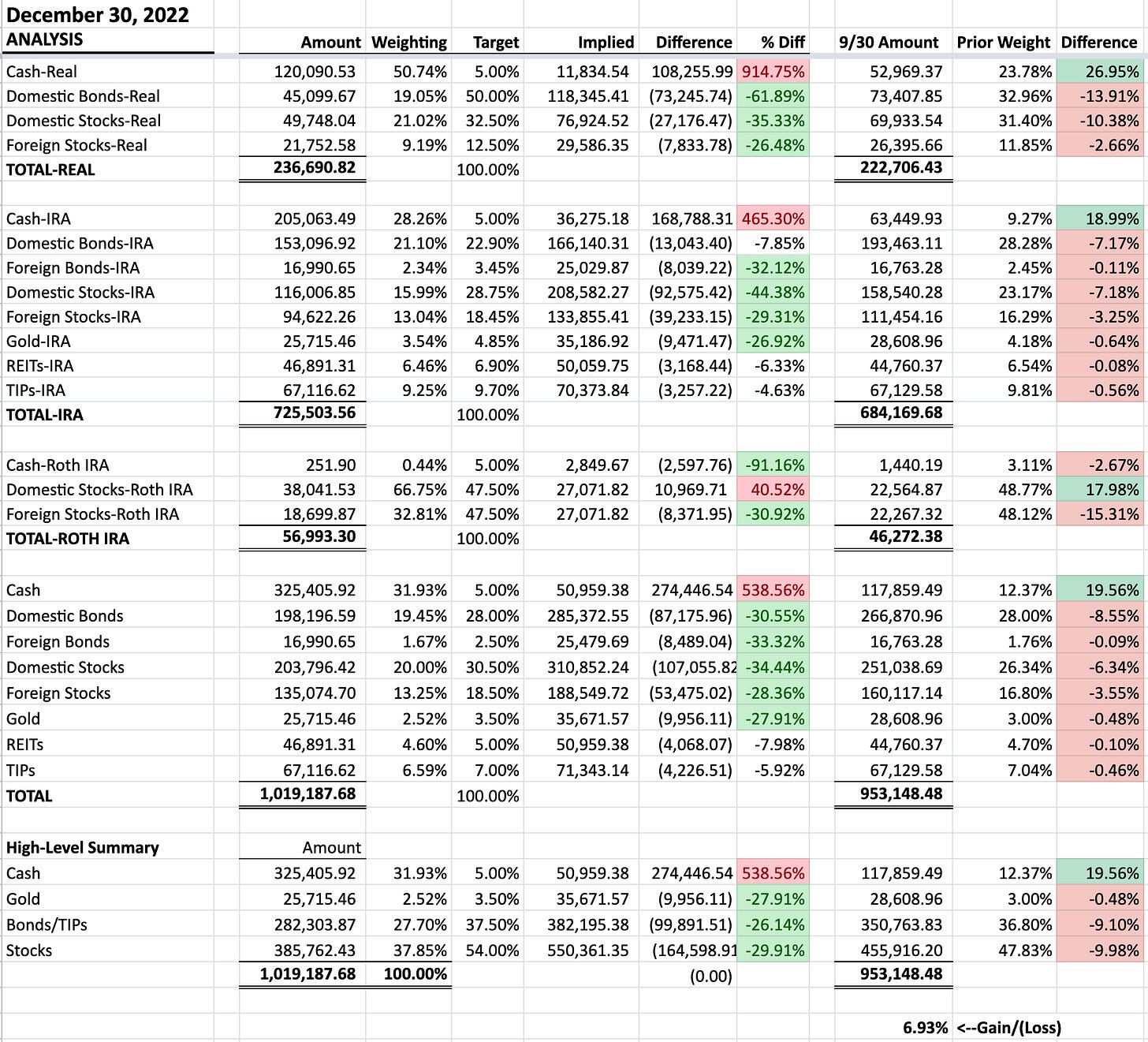

As I have featured previously, I first summarize the detail into 8 asset classes, and then at an even higher level into 4 asset classes. This helps me see the big picture, as well as the really big picture. As an example, I can see my weightings of domestic and foreign bonds, as well as TIPs, and how they line up against my target weights. But then I can also see the weighting for bonds as a whole.

Now that I am breaking out my portfolio, not just in terms of totals, but also in terms of asset location, I apologize for the fact that this first graphic is a little “busy.” But I will try to break it down so it is understandable.

First of all, the graphic summarizes my amounts by detailed asset class, but further between my investment account (shown as “real”), my IRAs, and finally my Roth IRAs. The bottom two sections are the totals, first by the 8 asset classes, and then at an even higher level into 4 asset classes, as referred to above. In each case, I compare them against my target weights and identify differences.

Next, on the far right of the graphic, I included my weighting as of the last quarter (9/30/22 in this case) and then a computed column to display the difference. I then color-coded in green and red to visually feature which weightings increased, and which decreased.

To help you ground yourself, then, take a look at the bottom line of roughly $1,019K and compare it against the $953K amount in the 9/30 column. As you can quickly see, the difference is the 6.93% gain I reported in the “bottom line” section.

I will break down some decisions I made during the quarter in greater detail in the sections below. However, in terms of the very biggest picture, focus for just a second on the high-level summary at the bottom of the graphic. You will see that I dramatically raised the cash level in my portfolio during Q4. I offer a fairly detailed rationale for this decision in a November post entitled Invest As If We’re In The 5th Inning.

NOTE: If you are a new reader, you might also want to catch up here and here to get additional insights into my thinking on this.

To close out this section, here are my detailed holdings as of 12/31/22. Again, you can see how each position has changed since my last report.

With that, let’s get into the detail in terms of asset location.

Taxable Accounts (TA)

Separately broken out, here is the portion of my portfolio in taxable accounts.

Next, the by-security detail of this portion.

In my Q2 update, I went into great detail about my personal circumstances and the theory behind my asset location decisions.

During Q3, I was able to take advantage of tax loss harvesting to reduce the amount of both equities and bonds I held in this account. In Q4, I made a few significant adjustments, as follows:

As explained in my asset location discussion, these are the funds I am drawing on for funding my expenses for the first few years of my retirement. That 50% weighting you see in cash paved the way for a large withdrawal into my online savings accounts right at the first of the year to do exactly that. When I report on Q1 2023, you will see that the cash allocation is more back in line with my go-forward target.

I took even more advantage of tax loss harvesting in both stocks and bonds.

I lightened up considerably on short-term bonds, as represented by BSV, and split the funds between cash and longer-term bonds, as represented by AGG. I noticed that I was getting more current income from my money market accounts than BSV. In contrast, AGG declined much more in value than BSV during 2022. So, my small addition gives me both higher current yield than BSV and also the potential for gains at whatever point interest rates possibly turn downwards.

Tax-Deferred and Tax-Exempt Accounts (TDA & TEA)

In previous updates, I broke these out into two separate sections, in line with my asset allocation articles. Now that I hope I have made all the necessary points, I am combining my two sets of retirement accounts (IRAs and Roth IRAs) into this one section.

Here, then, is the portion of my portfolio in tax-deferred accounts.

Next, the by-security detail of this portion.

Please note that the $782,497 balance reflected in the detail is the sum of the $725,504 in my regular IRAs (TDA) and $56,993 in Roth IRAs (TEA) reflected in the first graphic in this section. In my spreadsheet, I combine the detail because I want to be able to identify the total amount I have in each ETF, so I can accurately see its share of the whole.

As featured in my asset allocation articles, this is the second “bucket” of assets I will dip into and, if all goes according to plan, likely not for another 3-4 years.

In this final section, I will simply make 2 observations:

My substantial cash allocation in these accounts is in line with the “5th inning” article and other support linked above. As it turns out, this significant cash allocation was the biggest reason I slightly underperformed the model portfolio I manage for Hoya. I raised cash in that portfolio as well, but only to the level of 10%. While I follow the same principles in that portfolio as in my own, I tend to lean towards the side of being more fully invested.

Early in January, 2023, I made my second significant transfer of funds into my Roth IRAs, continuing with the same strategy I laid out in detail in this article.

Summary and Conclusion

Since this article is already quite lengthy, with multiple links to further reading for any who are interested, I will leave things here for now.

I will return with additional thoughts on the path forward in future articles.