Asset Location Part 2 - ETF Monkey's Personal Portfolio

In which I reveal and explain my asset location decisions.

In the first part of this two-part series, I offered a theoretical framework with respect to asset location. If you happened to land on this article directly, and have not read Part 1, I would encourage you to do so first. Without that foundation, some of the things I reference in this article may prove foreign.

In the closing section, here is what I promised for this second article in the series.

In Part 2 of this series, I will lay out how I am attempting to implement the above principles to the best of my ability within my personal circumstances. That doesn’t necessarily imply that you should, or will, do everything exactly the same way. But hopefully, if nothing else, it will offer you a nice baseline from which to build.

Let’s get right to it then, shall we?

The Big Picture

In my periodic update articles with respect to my personal portfolio, I start with what I call the “big picture,” and then list the details.

Before now, I have never broken thisout with respect to asset location. In this article, I will do so. However, to preserve at least a little privacy, I will disguise the actual amount I have in my portfolio.

Here’s how. I decided on $1 million as the amount to use for presentation purposes. I calculated the factor against which to multiply my total portfolio to arrive at an even million dollars. I then applied that factor against every component of my portfolio, such that all the relationships stayed the same.

An additional benefit of using an even $1 million as the total portfolio is that all the relative values stand out very clearly. I hope that helps as you consider your own portfolio.

Without further ado, then, the complete breakout of the big picture.

Some quick takeaways? It can quickly be seen that my total portfolio is comprised of 22.89% in taxable accounts, 72.16% in tax-deferred accounts, and 4.95% in tax-exempt accounts.

In the next sections, I will get into additional detail by account type.

Taxable Accounts (TA)

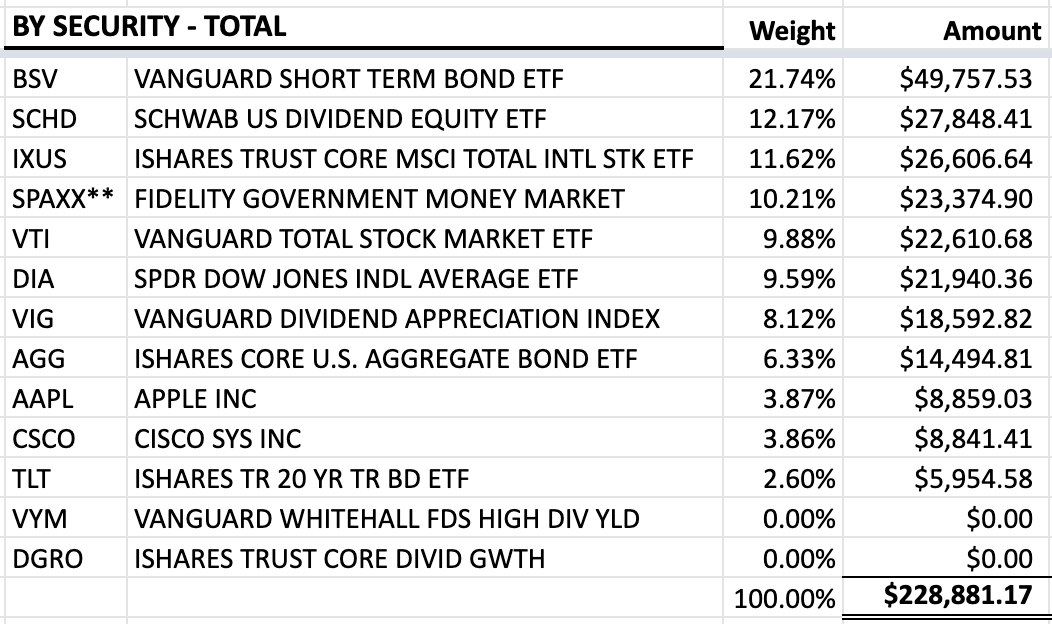

Separately broken out, here is the portion of my portfolio in taxable accounts.

Next, the by-security detail of this portion.

With a view to the theoretical framework presented in the previous article, let’s break down the reality of my personal circumstances.

Now that I am retired, I find myself in the decumulation phase referred to in part 1 of this article series. Happily, in addition to my retirement accounts, I was fortunate enough to be able to accumulate funds along the way in taxable investment accounts.

In short, here is my current retirement strategy. The current plan is to defer starting Social Security until full retirement age, which in my case is 67. So, for approximately the next 7 years, I will need to live off my investments. As featured in the previous article, the preferred sequence is to start by tapping taxable accounts.

In addition to the funds in my taxable investment accounts, I currently have roughly 6 months to a year worth of living expenses in online savings accounts. In combination, these should hold me for perhaps 3 or 4 years before I need to consider tapping any retirement (TDA or TEA) accounts.

With that, take a look at the weightings in my TA. Roughly 59% is currently in stocks. In a perfect world, that is perhaps a little higher percentage than I would like, but it is a function of the fact that, again as referenced in part 1 of this series, I had a preference for holding equities in my taxable accounts.

With that, though, take a look at one last detail. You will notice that roughly 32% of this account is comprised of cash and Vanguard Short Term Bond ETF (BSV). Combined with the cash in my online savings accounts, I estimate that these funds will carry me out at least 18 months or so into the future without undue risk.

Here’s the last observation for this section. You may notice that the only 2 individual stocks I still hold in my portfolio, Apple & Cisco, are in this account. This is because these are longtime holdings and I have unrealized capital gains in both. I will discuss tax strategy a little bit in the section on tax-exempt accounts (TEA) below.

Tax-Deferred Accounts (TDA)

For our second section, here is the portion of my portfolio in tax-deferred accounts.

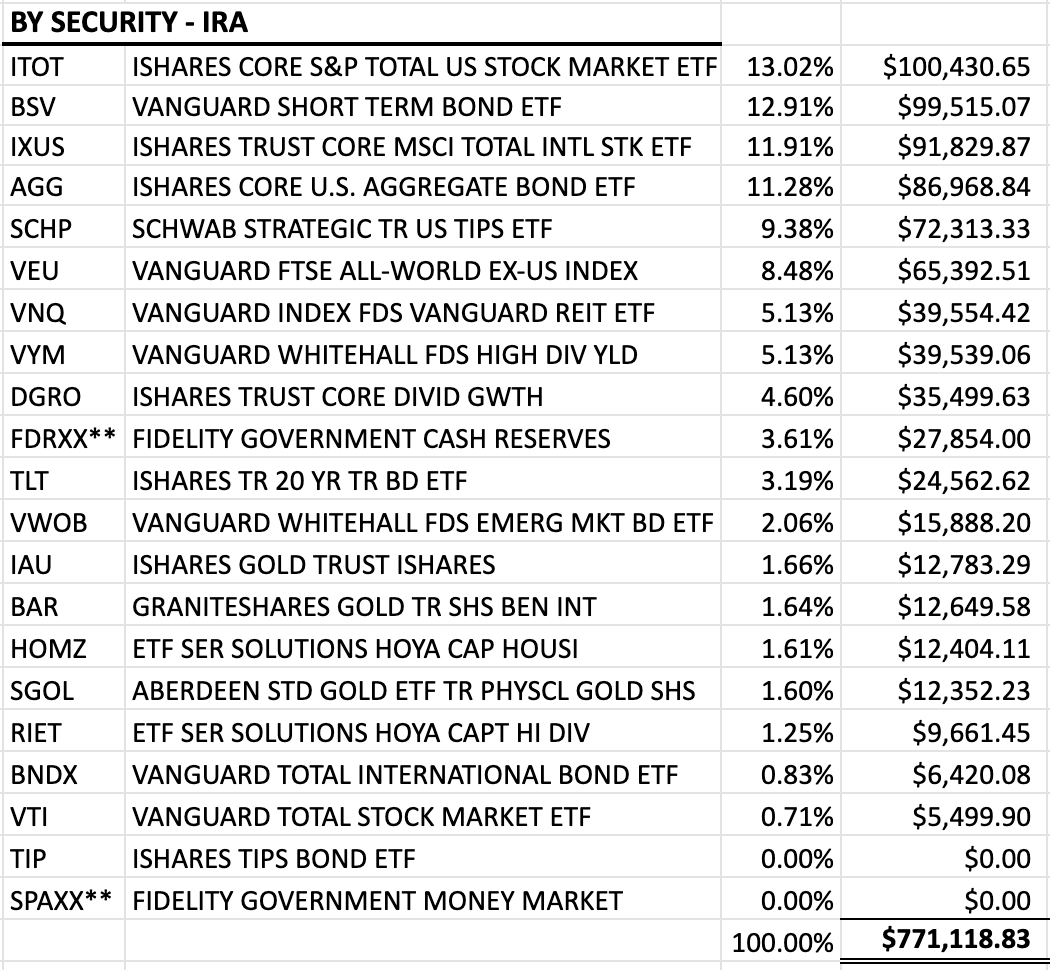

Next, the by-security detail of this portion.

Astute readers will likely note that, in this section, the detail doesn’t match the summary. As it happens, the $771,118 balance reflected in the detail is the sum of the $721,640 in TDA and $49,478 in TEA reflected in the next section. In my spreadsheet, I combine the detail because I want to be able to identify the total amount I have in each ETF, so I can accurately see its share of the whole.

As featured in the previous section, this is the second “bucket” of assets I will dip into and, if all goes according to plan, likely not for another 3-4 years.

It will likely be in this intermediate-term bucket that I make most of the weighting or rebalancing adjustments I desire to make to the portfolio. Philosophically, I don’t plan to make too many adjustments to the other two buckets.

Tax-Exempt Accounts (TEA)

This brings us to the last and, for me, the newest bucket. Here is the portion of my portfolio in tax-exempt accounts.

I opened Roth IRA accounts for myself and my wife for the first time this year. While I was working, I never contributed to a Roth IRA. Why? Remember, dollars contributed to a Roth IRA are after-tax dollars. While working, it was my belief that my combined tax rate was likely higher than it will in the future.

However, as I shared in the first section of the article, I was fortunate enough to retire with a modest sum of money in taxable accounts, consisting of both online savings accounts and investment accounts. As a result, I should be able to live off those savings for perhaps 3-4 years. The implication? At the present time, my taxable income has dropped to next to nothing. I make a very modest sum from my work at Seeking Alpha, but that’s all.

One technique that can be applied in my situation is to strategically shift some amount of money from one’s regular IRA into a Roth IRA (TDA to TEA). In so doing, I am voluntarily paying some level of income taxes this year. But it’s a low level, a level of my choosing. I’m in control. And, from this point on? Those funds are completely tax-free.

I plan to elaborate more on this strategy, and a couple of related tweaks, in future articles. But that’s a sneak peek.

But, for purposes of this article, back to asset location. You will notice that my TEA is virtually 100% equities. These are the funds with the longest time horizon to grow before I will need to tap them. And so these are the funds with, yes, the greatest volatility, but also the greatest amount of time to grow.

Summary and Conclusion

I hope you have enjoyed this two-part series of articles. As I mentioned, this is my circumstance. I probably don’t have everything perfect. And, as time moves on, I will need to pay careful attention to my withdrawal strategy, to use the funds from all 3 categories in the most tax-efficient manner.

As I mentioned in the previous article, depending on the complexity of one’s personal circumstances the services of a professional financial advisor may prove beneficial. It is often the case that such professionals have software tools that can forecast future returns and make the best possible calculations on your behalf.

If you think this article, specifically, would be of interest to a family member, friend, coworker, or similar, I would be ever so grateful if you would share it with them.

Lastly, I would genuinely enjoy feedback on this series of articles. If you have a comment, question, or even a criticism, feel free click on the button below. One of the things I enjoy about the writing I do is that it is often the case that I learn as much from some of my readers as they learn from me.

I look forward to returning to share more. Until next time, I wish you . . .

Successful investing!!

I really appreciate you sharing this, because I'm in a very similar situation, and it's not very typical. I retired two years ago at 61 with a decent sized taxable account. I'm also living primarily off my taxable account, while doing Roth conversions. And I have a similar allocation to equities in the taxable account. With any luck I should be able to live off the taxable account until I'm 70. Only then do I plan on claiming Social Security and taking Roth distributions. By that time I should have most or all of my IRA converted to a Roth, and I should be living mostly tax free. While most retirees seem to be searching for income, I'm doing everything I can to keep my income low so I can maximize Roth conversions. It's a different approach to retirement planning, but one I appreciate more as time goes by.

ETF Monkey, I'm late to this, having just seen the link in your latest Substack Post. I appreciate your sharing. I'm also managing my taxable income and converting IRA to ROTH. So, I appreciate your dual foci on both accumulation phase and distribution phases. It's been interesting to me that self directed investors seem to follow the same investment strategy in both phases (not adjusting much after retirement) even though their wage earning ability has changed. And I agree with you and Bill D. that managing taxes becomes much more critical as a retiree. And you have a few more tools available to do tax timing.