Powell At Brookings Institution - Caution Still Warranted

Did today's market action focus too much on one statement?

First of all, please allow me to quickly thank the many readers who have been with me for some time now, as well as extend a warm welcome to a fairly significant number of new readers who have joined over the past couple of weeks.

Wow, what a nice rise in the market to bring the month of November to a close! Following Jerome Powell’s speech at the Brookings Institution, my most-watched indicator, the S&P 500, jumped 3.09% on the day, closing at 4,080.11 and breaking through its 200-day moving average for the first time since March. My personal portfolio ended the day at a level I had not seen since roughly late-July.

It is my belief that today’s action reflected investors focusing on one brief excerpt from Powell’s comments. Here is that excerpt:

[I]t makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. (Italics mine)

What about me? So as to not “bury the lede,” I am hereby disclosing that I took advantage of today’s rally to sell enough ITOT and IXUS to raise my cash level to a full 25%.

This likely will not surprise longtime readers. In my last two articles, I explained why you should invest as if we’re in the 5th inning, and also revealed that I had significantly raised the level of cash in my personal portfolio, to 22.4% overall.

For the remainder of the article, I will offer a quick synopsis of Powell’s speech, and explain why I took advantage of today’s action to raise even more cash.

But first, if you are coming across my work for the first time, please take a minute to subscribe.

Digging In To Powell’s Speech

For any who are interested, here’s a handy link to the full text of Powell’s speech.

For those who might prefer a brief overview, I’ll try to summarize 10 double-spaced pages into a few hundred words, along with what I believe to be the key graphs in the presentation.

Powell began by reiterating that “without price stability, the economy does not work for anyone.” In particular, it hurts those least able to meet the high costs of essentials such as food, housing, and transportion.

The Fed currently estimates 12-month personal consumption expenditures (PCE) at 6.0%, and “core” PCE (which omits food and energy components) at 5.0%. Of course, these essential elements are the very ones that hit the poor the hardest.

Powell then commented that while many inflation forecasts “broadly show a significant decline over the next year,” such forecasts have been “predicting just such a decline for more than a year, while inflation has moved stubbornly sideways.”

This section of the discussion was supported by the following graphic. Note that, while there are peaks and valleys, the overall trajectory over 2022 is, as Powell said, sideways.

Powell then went on to break this out into 3 components;

Core goods

Housing services

Core services less housing

The graphic below features the recent behavior of these 3 components.

Starting with core goods, notice the sharp uptick in late-2020 and 2021 as people were forced to stay home, causing a strong demand for goods as opposed to services and straining pandemic-hampered supply. Since that time, supply chains have been starting to ease. While far from certain, Powell’s view is that goods prices “should begin to exert downward pressure on overall inflation in the coming months.”

In contrast, housing services inflation has been soaring, and continues to soar. While this indicator tends to lag, because of the slow rate of rental lease turnover, it appears that this will continue well into next year.

That brings us to the last component, core services less housing. As Powell worded it, this component “covers a wide range of services from health care and education to haircuts and hospitality.”

Because wages make up the largest cost in delivering these services, the labor markets hold the key as to where inflation may fall in this category. And here, the news is not quite so good.

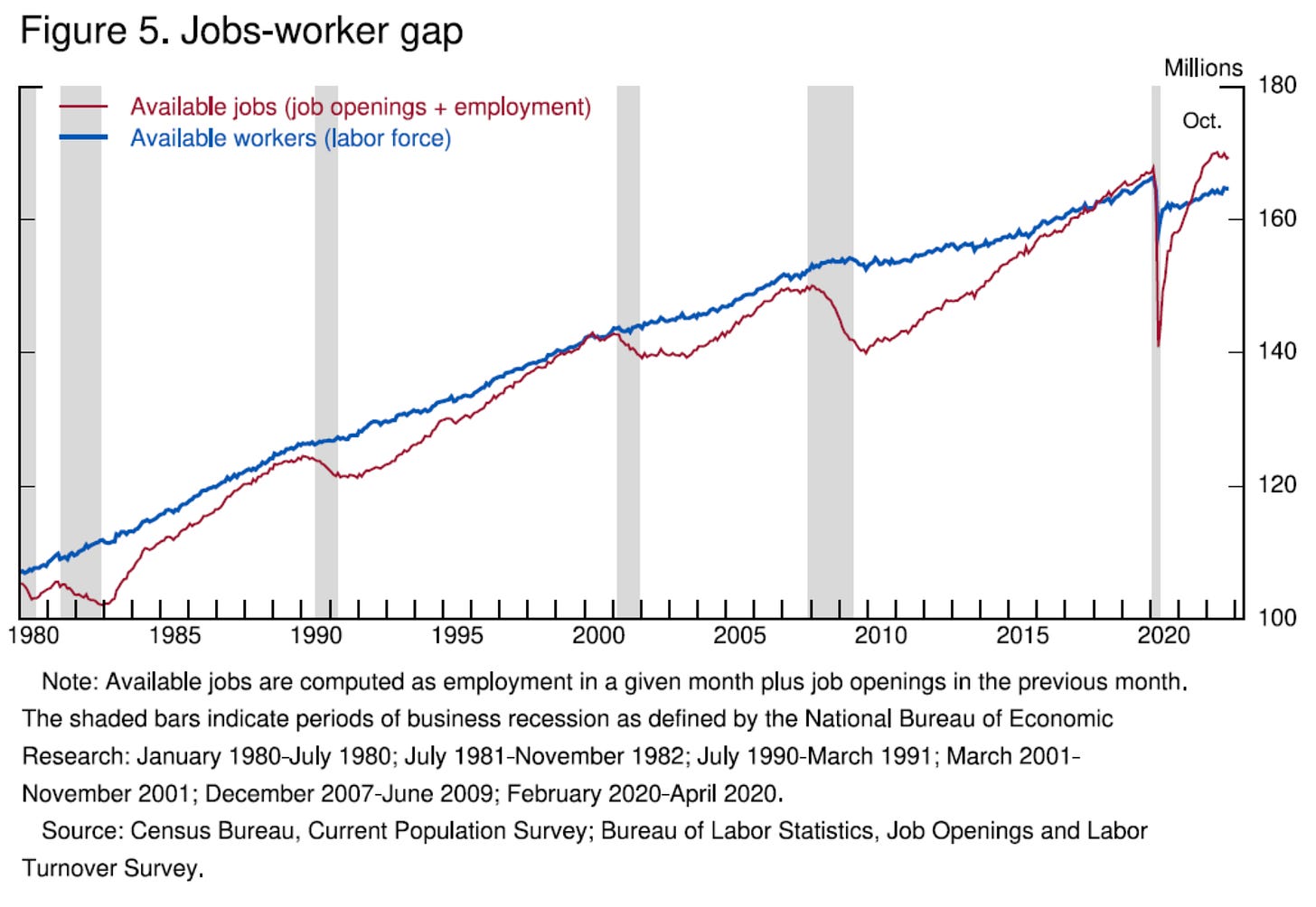

Powell next spent a fair amount of time discussing what is depicted in the next graphic. Note that the red line (available jobs) is now sharply above the blue line (available workers).

In short, a stubbornly large portion of employees that either quit or lost their jobs early in the pandemic have not returned to the work force. Powell lists several factors for this, including:

Those either currently sick with COVID or suffering lingering symptoms from previous COVID exposure (“long COVID”).

Excess retirements, which Powell believes “might now account for more than 2 million of the 3-1/2 million shortfall in the labor force.” Many of these may be older employees who lost their jobs during the pandemic and who are finding it extremely difficult to reenter the work force.

Sharp gains in both the stock market and housing prices over the first 2 years of the pandemic likely contributed to an increase in wealth that facilitated early retirement for some. (NOTE: For how Zoltan Pozsar from Credit Suisse believes this will impact the Fed’s goals, see here.)

Powell summed up this section of the discussion as follows.

Currently, the unemployment rate is at 3.7 percent, near 50-year lows, and job openings exceed available workers by about 4 million—that is about 1.7 job openings for every person looking for work.

Of course, the strong jobs market is a double-edged sword. Certainly, strong wage growth is a good thing. However, to be sustainable, it needs to be consistent with 2% inflation.

Looking To 2023

And with that, we come full circle. Towards the outset of the article, I featured the excerpt from the speech that I believe investors focused on today. I also featured that I took advantage of this market action to raise a little more cash.

To explain why, let me feature the excerpt that opened the article in context. In the quote below, I highlight that excerpt with italics. However, in bold, I share other portions of the comment that I believe investors also do well to consider.

Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

And with that, I will bring the article to a close. I hope it has proved interesting.

What do you think? Do you think I made a mistake by raising cash? Or do you think I am interpreting Powell’s comments, and the macro environment, more or less correctly?

Substack recently released a new feature whereby authors can host a subscriber chat, where readers can share thoughts on selected topics. I’m going to go ahead and open one for this topic. If you are on an iOS device, you can join in by downloading the Substack app. I believe an app for Android is also in the works.

Until then, see you next time!

Quick follow-up. I referenced the belief that a Substack Chat app for Android was forthcoming. In case you missed it, this app was released today.