Rethinking 60/40 - Your Best Portfolio Right Now Might Be 30/30/40

We live in most interesting times.

Late in Act I of the musical Hamilton is a song entitled “The World Turned Upside Down.”

This refers to the famous Battle of Yorktown. In this decisive battle, the British Army was forced to surrender to a combination of George Washington’s American forces and their French allies. This marked the conclusion of the last major battle of the American revolution, the start of a new independent nation, and ultimately George Washington’s election as the first president of the United States.

Truly, the world order of that day did turn upside down.

The World of Investing Has Also Turned Upside Down

When it comes to investing, it appears that the world has also turned upside down, so to speak, in the last year. I wrote about this late last year in a piece entitled Invest As If We’re In The 5th Inning. For purposes of this article, let me try to summarize in one concise paragraph what has taken place.

For several years, we existed in an environment of zero or close-to-zero interest rates and the deflationary force of increasing globalization. This combination produced stellar market returns, making fear of missing out (FOMO) the driving force for most investors. Over roughly the past year, all of these have reversed. Due to inflationary pressures, both the US Fed and other central banks have been forced to quickly and substantially raise interest rates and geopolitical changes and lack of trust between major world powers has reversed much progress with respect to globalization. At the same time, increasing returns from cash and bonds present headwinds to potential return from stocks.

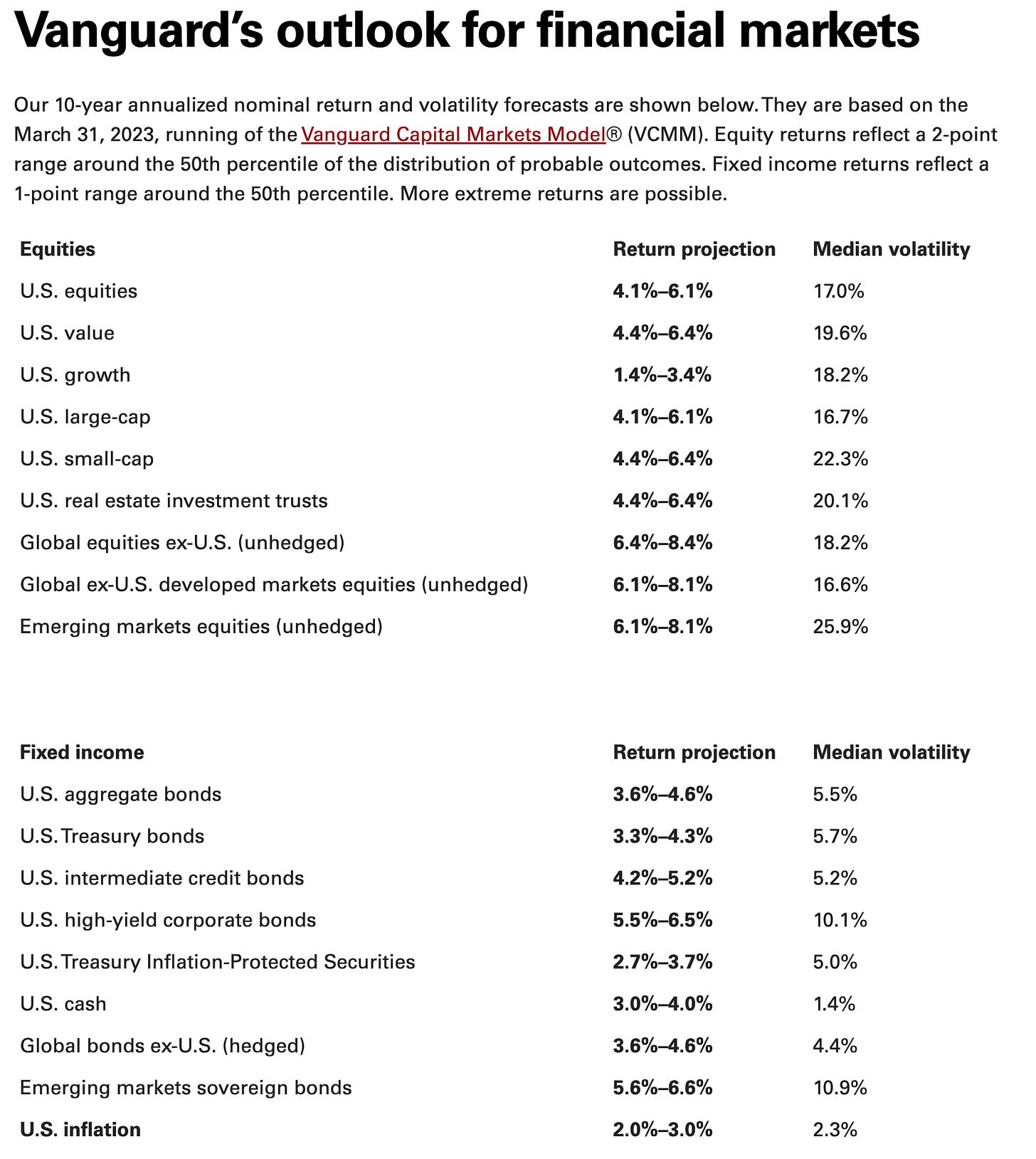

How has all of this turned the investing world upside down? For a nice graphical answer, have a look at the following 10-year annualized nominal return and volatility forecast from Vanguard.

Let’s start with the bottom line of the graphic, projected U.S. inflation. According to Vanguard, this is expected to come in somewhere between 2.0-3.0%.

Of course, as investors, our goal is to not lose ground to inflation. With that in mind, however, take a look at the projections across the board for other asset classes. What jumps out at you? Here are a few of my takeaways:

U.S. cash, long a wasteland in terms of generating any returns, manages to keep up with inflation.

The projected return for U.S. equities is not much higher than U.S. bonds, roughly .5%-1.5% higher, but with much greater volatility.

Global equities, particular those of developed markets, offer the potential for greater gains without any increase in volatility.

Of course, that is over the next 10 years. Recently, however, the market has experienced a very strong surge. In fact, just this past week, the S&P average entered into what Wall Street refers to as a bull market.

From this, it could be easy to be drawn back into FOMO mode. My advice; be careful. Not everyone is buying into this.

I could offer a variety of viewpoints but, for now, just one, from legendary investor Stanley Druckenmiller, during a recent interview with Bloomberg.

One of the topics that came up had to do with the outlook for either a hard or soft landing in the months ahead. Druckenmiller reminded that we are still working off excess liquidity from stimulus introduced during the pandemic. Further, that Janet Yellen had drained the Treasury account in the period leading up to the recent debt ceiling vote. However, following the vote to raise the debt ceiling, this will all change, as roughly $800 billion of issuance of Treasuries will dry up liquidity from other segments of the market.

In terms of the probability of a hard or soft landing, here is how Druckenmiller summarized the discussion.

To me, the probabilities haven’t changed. It’s been pushed out relative to expectations. But in no way does the fact that it hasn’t started yet change the probability of whether [the landing] is gonna be hard or soft. I would actually argue, since it’s taken so long, the Fed has ended up with a higher terminal rate, inflation gets stickier the longer it stays in the system, that it increases, not decreases, the probability of a hard landing. (Bold mine)

In addition to Druckenmiller’s comments, I remain concerned by the fact that U.S. household debt continues to rise, crossing the $17 trillion threshold during Q1 2023. This, combined with recent comments from major retailers at investor presentations, appears to reveal that at least some U.S. consumers are stretched thin, and even relying on debt to provide for basic needs or possibly to maintain a lifestyle to which they have become accustomed.

Enter The 30/30/40 Portfolio

Most investors are very familiar with the famous 60/40 portfolio, comprised of 60% stocks and 40% bonds.

In this “upside down” world, however, some are starting to feature the concept that a balance of something like 30% cash, 30% bonds, and 40% stocks may be worth considering.

As you ponder this, look at something I tracked recently from my own portfolio. For longtime readers, the numbers featured here are produced the same way I shared my portfolio in recent quarterly updates; as factored values from my portfolio designed to simulate a $1 million portfolio.

In this spreadsheet, I sought to calculate the approximate annualized returns from my May dividend payments. Please note that, overall, my current return from cash and bond sits right at 4%.

However, look closely at how that breaks down. As can be seen, the cash in my Fidelity money market accounts returned roughly 4.7%, short-term bonds as represented by BSV roughly 2.3%, overall U.S. bonds as represented by AGG roughly 3.1% and long-term Treasury and Corporate bonds as represented by TLT and BSV an overall average of about 3.7%.

Think about that for a second. In a normal investing world, the expectation would be that bonds would provide greater return than cash. At this point, it is simply not the case, at least in terms of dividends paid. Even going all the way out to my long-term bonds, cash still offers a superior current return. Further, while the market has been strong of late, one can go back two full years at this point and basically have been treading water in stocks. And it is not at all impossible that this could continue in the near term.

And that’s where the idea of the 30/30/40 portfolio comes into play, as follows:

30% Cash - This segment of the portfolio is providing even higher current returns than a diversified bond portfolio. This both provides for decent current income as well as “dry powder” to invest in a potential market downturn. Ironically, Stanley Druckenmiller, featured above, has recently mentioned that he has significant cash holdings while he awaits a “fat pitch” he can swing at in the markets, and that he currently has not seen such a pitch.

30% Bonds - Despite the fact that cash is currently providing superior cash returns, bonds tend to outperform over the long term. In fact, the more interest rates rise, the more attractive bonds become, because they offer the potential for both income and capital gains at such point that interest rates fall. In that scenario, bonds also provide protection against reinvestment risk. In other words, you may not always get that 4.7% return from cash. Say interest rates fall and that drops to 3%. There goes roughly 1/3 of your income. In that environment, however, the capital gains from bonds would serve as a nice offset.

40% Stocks - This maintains a decent balance in the market, avoiding drastic attempts at market timing. In my personal case, I am currently sitting at about a 60/40 split between U.S. and foreign stocks. However, the case could even be made for a 50/50 split here, based on the Vanguard forecast I shared above.

In this article, I hope I have given you something to at least think about. For what it’s worth, this is right about where I currently sit in my personal portfolio. I hope to return with another report on how I’m doing at the end of Q2.

What do you think? I’d love to hear. Feel free to share your views in the comments below.

As Dorothy would say,"Toto, we aren't in Kansas anymore."

Cash is clearly uncorrelated to the market, and if it's producing adequate returns, it should be a larger part of a balanced portfolio.

Strange times indeed.