Portfolio Evolution - Simplifying My Allocation To Utilities

In which I choose to take the simpler path.

If you were to compare my most recent ‘Take a peek into ETF Monkey’s portfolio’ offering with an earlier version, you would notice something. Actually, you would notice several things. But, for this note, I will focus on just one.

A Dedicated Allocation To Utilities

In the ‘by asset class’ overview of the earlier version, you would notice a dedicated target weight of 2.57% to utilities. Some years back, I decided that I liked this approach, as utilities are truly fundamental to how more or less everything else operates. You can do without a lot of things in life but, for most of us, utilities are not in that category.

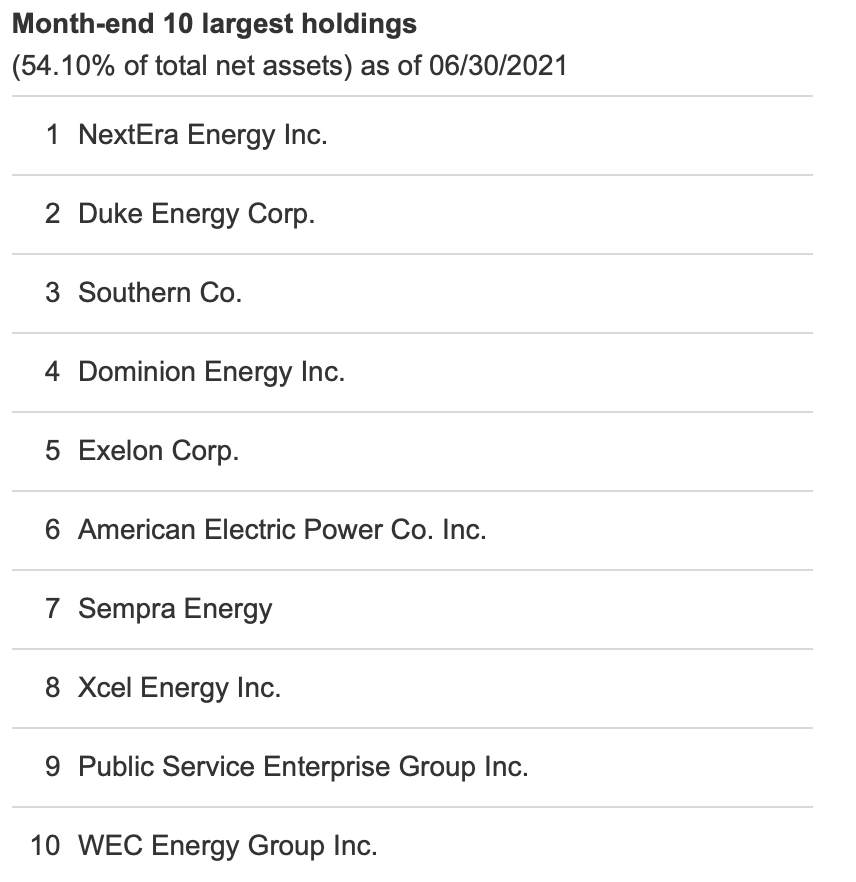

Further, maintaining a dedicated allocation to this asset class is not at all difficult. My ETF of choice was Vanguard Utilities ETF (VPU). It’s a great ETF; been around since 2004, almost $5 billion in AUM, expense ratio quite modest at .10%. Here’s a look at VPU’s Top-10 holdings.

Again, nothing at all wrong with VPU. However, a couple of months back, I made another rather significant adjustment to my portfolio and, in the process, picked up a healthy number of shares of Vanguard High Dividend Yield ETF (VYM) and iShares Core Dividend Growth ETF (DGRO). Additionally, I already held shares of iShares Core High Dividend ETF (HDV).

A Realization

In the process of reexamining VYM for possible inclusion in my portfolio, I noticed something. Sure, I had noticed it before when writing about this ETF, but perhaps I thought about it a different way this time around.

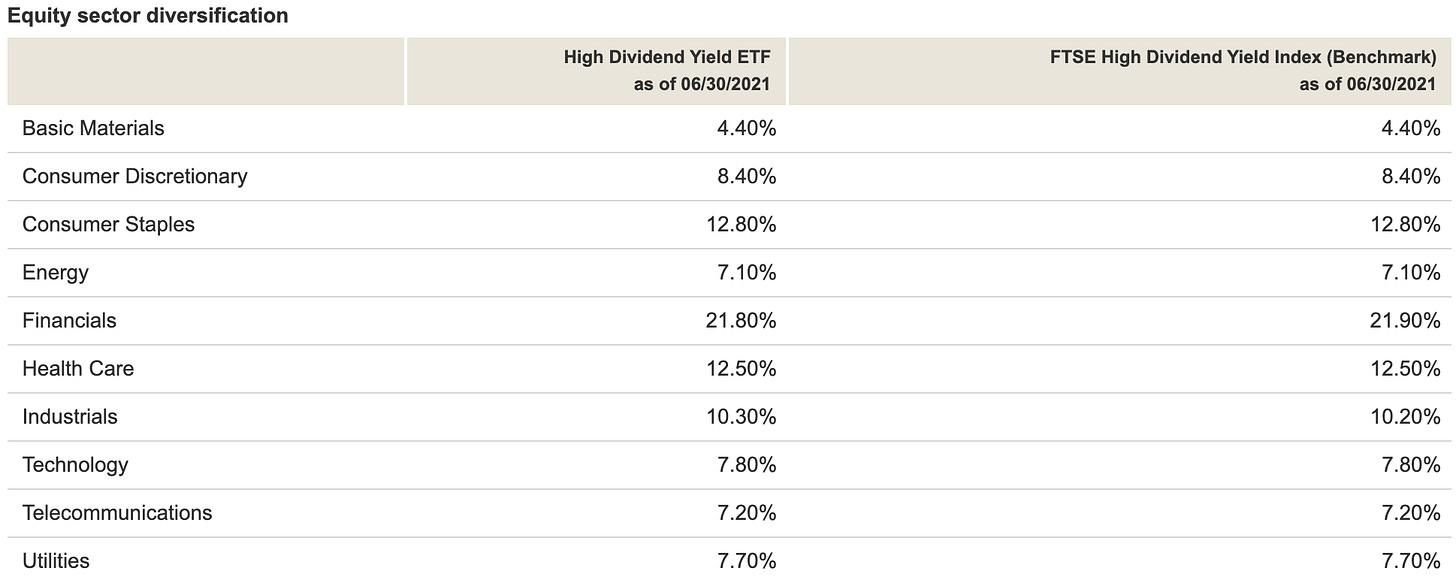

Have a look at the last asset class in VYM’s breakdown.

That’s right. Utilities. At an almost 8% weighting at that.

Digging just a little further into VYM’s full portfolio holdings list, I quickly noticed that all of VPU’s Top-10 holdings are in VYM as well. Not as heavily weighted, of course, but there.

In the VPU Top-10 list above, you will quickly find Duke Energy, Southern Co, and Dominion Energy. I picked these 3 because their weightings are fairly close together, so I could capture them nicely in the below screen capture from VYM.

Continuing my exploration, I next decided to take a closer look at HDV, one of my existing holdings. Have a look at what I found.

Yep, there they are again. Utilities. Not only that, but an 11.06% weighting among this ETF’s relatively small total of 75 holdings. Further, several of the heavily-weighted names in VPU are found here as well.

One last factor. While, as featured above, VPU has an attractive expense ratio of .10%, VYM and HDV sport even lower ratios, at .06% and .08%, respectively. Bear in mind, I am a long-term investor. So even these little details add up over time.

Simplification

And so, I made the decision to simplify. I decided that, while I liked the idea of holding utilities in my portfolio, I didn’t need to go to all the trouble of maintaining them as a distinct asset class, rebalancing in and out of them, and the like.

So, I sold my holdings in VPU and, as mentioned previously, as part of a larger simplification and restructuring, added a substantial amount of VYM and DGRO. Between the significant amount of VYM I added, and my existing holdings in HDV, I am happy with my new, simplified, exposure to utilities.

Department of Shameless Plugs

Thanks for reading. Please feel free to . . .

Besides leaving a comment on this particular article, if there is some other topic you would like me to consider writing about, here’s your opportunity to ask. This forum has the ability for me to create discussion threads, more centered around reader discussion, in addition to traditional posts such as this one. However, I am setting myself a goal of getting at least 100 readers subscribed before I start up with those, so the discussion has a half-way decent chance at being meaningful.

Related to that goal, perhaps you have family, friends, neighbors, or coworkers who might be interested in financial topics? If so, I would be most grateful if you took just a second to . . .

Moving forward, this will likely be my best option to share all my writings, including on my personal website, TheStreet.com, and possibly Seeking Alpha.

Until next time, I wish you . . .

Happy investing.