A 2-ETF Package That Beat The S&P 500 Over The Past 10 Years

Not just superior absolute return, a superior risk/reward profile.

Readers might recall that, back in October, 2022, I wrote an article entitled Digging In Deeper On My QQQM Purchase - And A Bonus. I "put my money where my mouth was" by also doing exactly what I proposed, adding QQQM to the Roth IRA accounts in my personal portfolio.

In a recent article for Seeking Alpha, I decided to review Schwab U.S. Large-Cap Growth ETF (SCHG). Bottom line? Given my already well-documented view as to how 2023 may play out, while I thought that SCHG had much to offer in the right environment, I was not sure that this ETF would be my choice for 2023.

However, something caused me to wonder how SCHG might fare in combination with Schwab U.S. Dividend Equity ETF (SCHD), another ETF that has long been a favorite of mine and which I hold in my personal portfolio. As it turned out, the results were very impressive. I performed a backtest using Vanguard S&P 500 ETF (VOO) as a proxy, and found that an SCHG/SCHD combination had beaten the performance of the S&P 500 over the past 10+ years!

In turn, that got me wondering what would happen if I substituted QQQM for SCHG. As it turns out, this combination was even better!

Let’s take a look together, shall we?

QQQM & SCHD - Beating The S&P 500 Over 10 (OK, Actually 11) Years

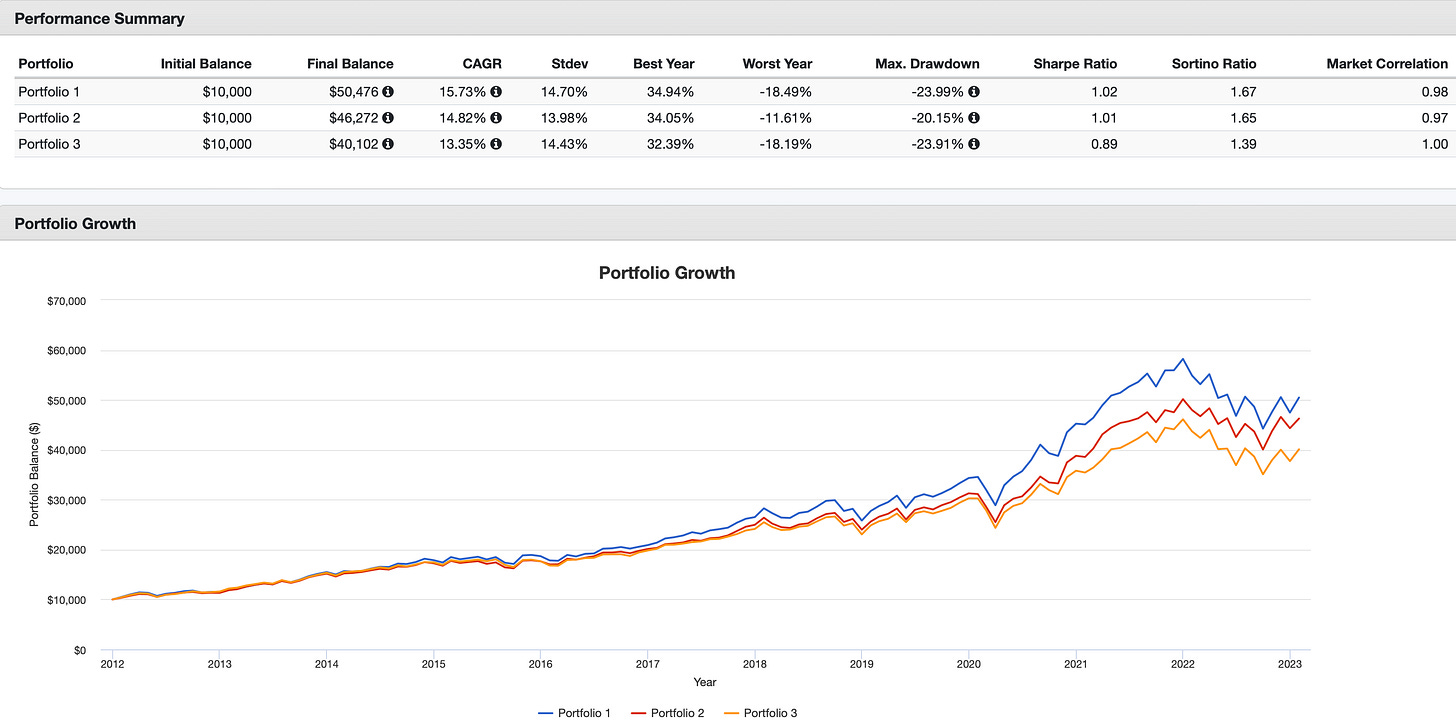

Here are the results, using the following backtest from Portfolio Visualizer. The backtest covers the period from January, 2012 through January, 2023, or 11 full years, constrained by the inception date of SCHD. I included and reinvested all income, and rebalanced the mix semi-annually.

In the backtest, I include 2 comparisons:

A simple 50/50 mix of QQQM and SCHD.

For more conservative investors, mix of 27% QQQM and 73% SCHD. This lowers the growth potential but also dramatically decreases the volatility.

NOTE: Due to the recent inception date of QQQM, I had to use QQQ in the backtest to cover the same span. However, as noted in my original article on QQQM, the long-term performance of QQQM should, if anything, be slightly better than QQQ due to its lower expense ratio.

So, here are the portfolios. As can be seen, Portfolio 1 is our 50/50 mix of QQQ/SCHD, Portfolio 2 the more conservative 27/73 mix, and Portfolio 3 is 100% VOO. I picked VOO because, due to its extremely low expense ratio, it is about as good an ETF proxy for the S&P 500 as you can choose.

And here are the results.

First of all, please note that both the 50/50 mix and the more conservative 27/73 mix beat the S&P 500, as represented by VOO, over this 11-year span.

And when I say “beat,” I am not referring to outperformance as simply a matter of total absolute return. Over a long stretch such as this, a "riskier" portfolio should outperform a more conservative one simply by virtue of the additional risk. Typically, however, increased volatility comes along as part of the package. In this case, the overall volatility of the 50/50 mix (Portfolio 1) was almost identical to VOO alone, while delivering far superior absolute returns. Note the sharply higher Sharpe and Sortino ratios, implying a superior risk/reward profile.

Moving to Portfolio 2, please note why this mix might be more desirable for conservative investors, such as a recent retiree like myself. In this iteration, we have given up a little potential for total returns, but please notice the fairly substantial decrease in downside risk. You will notice that the Sharpe and Sortino ratios are still almost identical to the more aggressive 50/50 mix. In this case, let me feature that even the 27/73 mix beat VOO in terms of total return.

What, though, about income? Here also, both iterations of the portfolio hold up extremely well.

Right off the bat, you likely notice both iterations of the QQQ/SCHD portfolio generated more income than VOO. For retired investors, who may be interested in more current income, Portfolio 2 offers perhaps the best option.

Summary, Conclusion, And Shameless Plugs

I can’t help but smiling at the fortuitous turn of events that led to this discovery. As featured, I started the journey with the goal of simply reviewing a single ETF, and ended up with an interesting revelation.

I hope that this article has not only been interesting, but given you some actionable intelligence that you can consider relative to your own circumstances and goals.

If this proves to be the case and you are not yet following me, here’s a handy link with which to do so.

Going a step further, if you have relatives or friends who may also find this of interest, I’d be deeply honored if you would do both them and me a favor and pass it along.

One last thing before I leave you today. Substack recently added a chat feature that I am taking advantage of to post “quick hits,” ideas that cross my mind that I would like to share quickly without necessarily sitting down to write an entire article.

Here’s a recent example of one, from last Thursday.

As you can see, one reader replied, and happened to agree with me. As it happened, the market indeed did decline over the past couple of days, and I re-bought some shares today (2/6) that I sold on 2/2 as referenced in the quick note above, making a couple of bucks in the process.

Now, I won’t always get it right. But I will always try to share my best thoughts with readers.

If you’d like to take advantage of this, here again is a handy link. The Substack app is available for both iOS and Android.

Until next time, I wish you the very best on your investing journey!