Recency Bias – An Enemy Of Successful Investing

Remember, the past does not necessarily predict the future.

Recency bias has been defined as “the unfounded conviction that recent trends will continue into the near-term future.”

In this short piece, I would like to feature one example of how recency bias could adversely affect your investment decisions at this precise point in time.

Foreign Stocks – A Recent History

For some years now, I have been advocating that investors include an allocation to foreign stocks in their portfolios.

In contrast, some investors choose not to go this route. For years, I have written for Seeking Alpha. This platform offers a robust capacity for reader comments. So often, over the years. I received comments such as “I stick with U.S. stocks,” “I don’t trust foreign stocks,” and the like.

Looking back over the past few years, it has indeed been the case that U.S. stocks have outperformed their foreign counterparts. Have a look at the graphic below, from Portfolio Visualizer. I did a simple backtest, comparing Vanguard Total Stock Market ETF (VTI) and Vanguard FTSE All-World ex-US ETF(VEU) for as far back as the analysis would take me. As it turns out, this was all the way back to January, 2008.

(NOTE: Vanguard Total International Stock ETF (VXUS) would have been a more perfect comparison, as it encompasses more small-cap stocks. However, its inception date is 4 years later, so VEU offered a longer span of comparison. As a practical matter, the performance of VEU and VXUS tends to be quite similar.)

Clearly, starting in approximately 2011, U.S. stocks have been on a tear. And the gap has exploded this past year, since COVID.

Looking Forward – And Recency Bias

Here’s where recency bias comes in. Based on these results, an investor might be tempted to jump into U.S. stocks with both feet, ignoring a balanced allocation to foreign stocks.

To be sure, there is a lot to think about. For example, several countries, particularly in emerging markets, may be more directly affected by economic challenges related to the war in Ukraine. It is not my intent to minimize any of that.

Might those risks, however, already be appropriately discounted when it comes to foreign stocks? To examine this, I pulled up the Portfolio & Management tab for our two ETFs, VTI and VEU, on the Vanguard website. Each page is linked in the caption for the related picture.

First, from VTI.

In the graphic, focus on the ratios in the right-hand column. These relate to how “expensive” the components of the ETF are, as well as their growth. As of this writing, then, the collective stocks in VTI trade at a P/E ratio of 19.3, and a P/B ratio of 3.5.

Next, the same graphic, from VEU.

In comparison, then, a P/E ratio of 11.9, and a P/B ratio of 1.7. In the case of the P/E ratio, roughly 60% as expensive as their U.S. counterparts. In the case of the P/B ratio, less than 50%.

Put simply, then, the recent (there’s that word again – recent) stellar outperformance of U.S stocks has left them significantly more expensive than their foreign counterparts. Given this observation, it may prove beneficial to ponder your own allocation to foreign stocks, and whether it has been, even subconsciously, affected by recency bias.

Recency Bias And Vanguard Retirement Portfolios

Reading through that last section, however, I would forgive you for thinking: “Well, so that’s how ETF Monkey feels. That’s all well and good, but is there any other evidence I could look to?”

As it happens, there is.

Investment powerhouse Vanguard offers professionally managed mutual funds that are designed for investors hoping to retire at a certain target date. Vanguard adjusts these stock/bond allocations such that they become more conservative as the targeted retirement date draws closer.

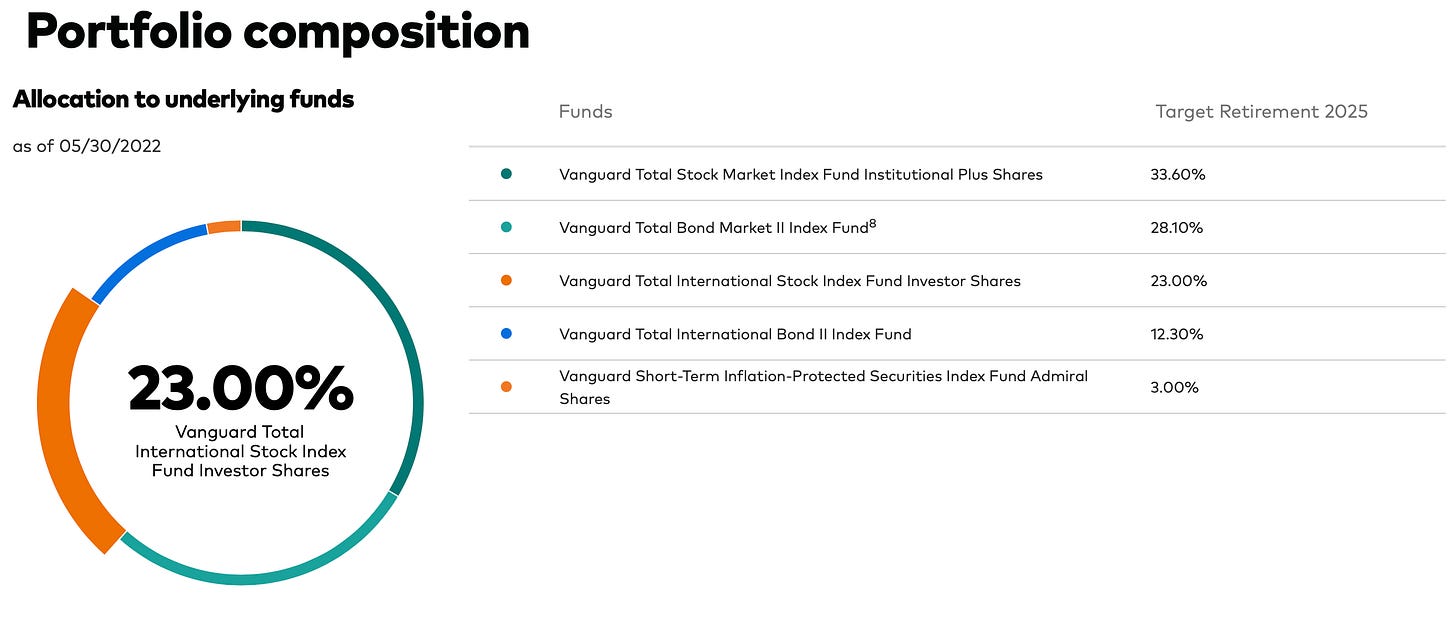

With that in mind, here are the current allocations in the 2025 version of the fund, for an individual targeting retirement approximately 3 years from now. Again, the caption is a link, in case you want to take a look for yourself.

Next, the 2050 version, for someone approximately 28 years away from the glorious day of retirement.

For the purposes of this article, however, I want you to notice just one commonality. Please compare bullet points 1 & 3 in the first graphic, and 1 & 2 in the second graphic. While the exact weightings are different, as appropriate for two very different retirement dates, there is a healthy allocation to international, or foreign, stocks in both cases.

So no, it’s not just ETF Monkey’s opinion. The pros who handle literally billions of dollars in retirement assets don’t fall victim to recency bias. They stay properly diversified. And so, I suggest, should you.

Until next time, I bid you . . .

Happy investing!