Towards the end of my last article, on the road ahead for the Fed, I said:

I hope to, in future articles both here and on Seeking Alpha, write a little more about the reasons for [a strong likelihood of periods of recession and even stagflation].

Earlier this week, I wrote a follow-up for Seeking Alpha, entitled The World Of 4,818 Faces An Uncertain Future. In that piece, the expression “the world of 4,818” refers to the confluence of circumstances that allowed the S&P 500 index to peak at 4,818 during the trading session of January 4, 2022. If you have the time and capability, you might enjoy the full article, along with all the supporting material.

Basically, I posited that this “world” was comprised of 2 elements:

Financial - A decade-long period of easy money, unprecedented stimulus, and cheap credit.

Geopolitical - A decades-long era of increasing globalization, improving supply chains, and cheap resources (labor, goods, and commodities).

Happily, the editors over at Seeking Alpha thought the article good enough that they tagged it to SPY, the ticker symbol for SPDR S&P 500 ETF Trust. That ensures fairly substantial readership, as SPY is the most-followed ETF ticker on the site.

Per the terms of my exclusive content agreement with Seeking Alpha, I can only reproduce brief excerpts from the article in any other work.

However, for the benefit of my readers here, I will use different content to basically share the same message, and will incorporate a few snippets from the Seeking Alpha article as allowed within their guidelines.

The World of 4,818 No Longer Exists

This past May 15, I wrote a post based on a then-recent note from Credit Suisse Investment Strategist Zoltan Pozsar. More recently, Pozsar shared another note. In this note, he features that, in addition to cheap money and abundant stimulus, for the past few decades the world trended towards globalization. Goods were produced as cheaply as possible, then transported efficiently to the ultimate consumer. Pozsar refers to this as the "low inflation world."

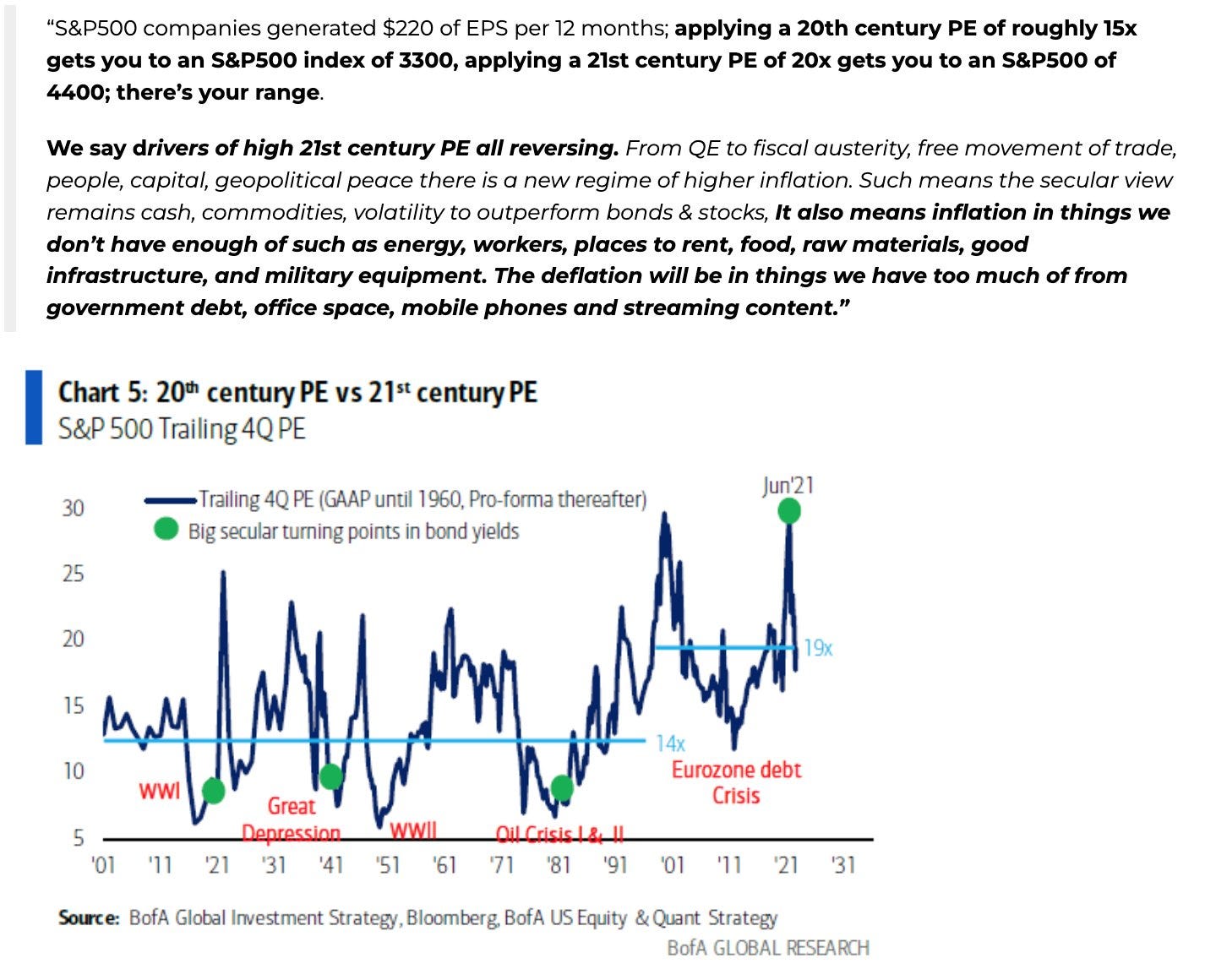

He goes on to submit that, at least for the foreseeable future, this world no longer exists. Interestingly, I ran across basically the same message in this recent graphic from BofA Global Research.

The commonality in the two thought pieces is that so many of the drivers of “the world of 4,818” have reversed. Not just is the Fed, from all apparent evidence, intent on raising rates until they are convinced that inflation is well on its way back to where they want it to be, but the geopolitical landscape has shifted dramatically.

Here is how I summarized it for Seeking Alpha.

In February, long-simmering tensions between Russia and the West (including NATO) became a "hot war" as Russia invaded Ukraine. Commentators suggest that this was inspired by Vladimir Putin's world view of a Russia that assumes its rightful place in the world, as leader of a Eurasian empire that stands in opposition to the "decadent" west.

These events have had significant economic ramifications, and not in a good way. Europe, in particular, may be headed for an extremely difficult winter.

Meanwhile, China, under Xi Jinping, appears to be bent on reversing what Chinese refer to as the "Century of Humiliation". Following reforms initiated by Deng Xiaoping that led to an impressive economic and military ascent, China has been flexing its muscles in Hong Kong. Additionally, recent events in Taiwan have led to the highest level of tension between the U.S. and China in modern history.

Take a look at that quote, as well as the quality supporting material referenced in the links, and then have a look at the text of the BofA Global Research graphic above.

Frankly, I don’t think I can present it any better than that. I will simply say that Pozsar’s recent note essentially says the same thing but more eloquently and in much more detail. Further, recent material from Ray Dalio’s fund, Bridgewater Associates, such as this item from our friends at Seeking Alpha as well as other material, suggests a potential transition to stagflation along with challenging times ahead for the stock market.

Powell At Jackson Hole

Each year, roughly 120 academics, global central bankers, and journalists meet in the resort town of Jackson Hole, Wyoming. The event is held by the Kansas City Fed and is called the Jackson Hole Economic Symposium.

Tomorrow, Friday morning, Fed Chairman Jerome Powell speaks. In the opening paragraph of this article, I reference my own article on comments recently made by Minneapolis Fed President Neel Kashkari. I am eagerly waiting to see how closely what Powell says tomorrow mirrors Kashkari’s prognosis.

It’s been great sharing this with you.

Feel free to drop a comment in the comments section below. I’d love to hear from you.

Feel free, also, to share this information with friends and colleagues who might find it of interest.

I look forward to chatting with you again soon.