Investing Successfully In An Inflationary Environment

Solidifying Both The Short- and Long-Term Horizon

Likely you are worried about inflation. It seems it is on everyone’s minds these days, including mine.

A recent article in The New York Times featured the most recent Consumer Price Index (CPI) value for the United States. As shown in the below graphic, this number came in at 8.5%. As can further be seen, the challenge is not confined to the U.S., with several other countries notching values as high as 7.6%.

In such an environment, investors are justifiably worried about the potential for inflation to erode their purchasing power. Even during relatively benign periods, this can be the case. As an example, a recent article in Forbes magazine featured the fact that a movie ticket averaged $2.89 in 1980. By 2019 the average price had risen to $9.16. So that $10 bill that granted you 3 admissions in 1980 bought you exactly one ticket in 2019.

If it were only movie tickets that we had to worry about, life might not be so bad. But when inflation ravages the price of gasoline we put in our cars, groceries that feed our family, and the rent or mortgage payment on the very home in which we live, this is no laughing matter.

Investing For Both the Short and Long Terms

Fortunately, we can find both some good news, and helpful advice, in a recent paper entitled US Inflation and Global Asset Returns, by Wei Dai and Mamdouh Medhat.

Here’s the good news. For long-term investors, it has historically been possible to outpace inflation by building an asset allocation that emphasizes asset classes with high real returns, such as equities.

Here’s the challenge. For investors who also must balance the needs of a shorter time horizon, such as those at or nearing retirement age, care must be given to providing at least some sort of near-term hedge against loss of purchasing power.

In so doing, the investor is presented with a smorgasbord of options from which to choose. In addition to inflation-indexed securities, such as Treasury Inflation-Protected Securities (TIPS), commodities, value stocks, and stocks in “inflation-sensitive” sectors, such as energy.

Key Takeaway: The authors suggest that investors requiring a near-term hedge against loss of purchasing power exercise caution when considering alternatives to inflation-indexed securities.

The Study

In the study, Dai and Medhat examine the relationship between inflation and the returns for various asset classes over two long periods. The long sample is from 1927-2020 (94 years) and the more recent sample from 1991-2020 (30 years).

In the case of the long sample, no less than 23 asset classes were examined. In the shorter sample, yet another 7 asset classes for which information is now available were added.

In this first exhibit, the two time spans are graphically represented. A median inflation rate is calculated across the spans. Years that exceeded the median are defined as high-inflation years, years below the median as low-inflation years.

In the graphic above, please take note of the fact that inflation has been relatively benign during the 1991-2020 period. In the longer period, due to periods such as the Great Depression and World War II, along with the inflationary period of the 1970’s, the swings are much more pronounced.

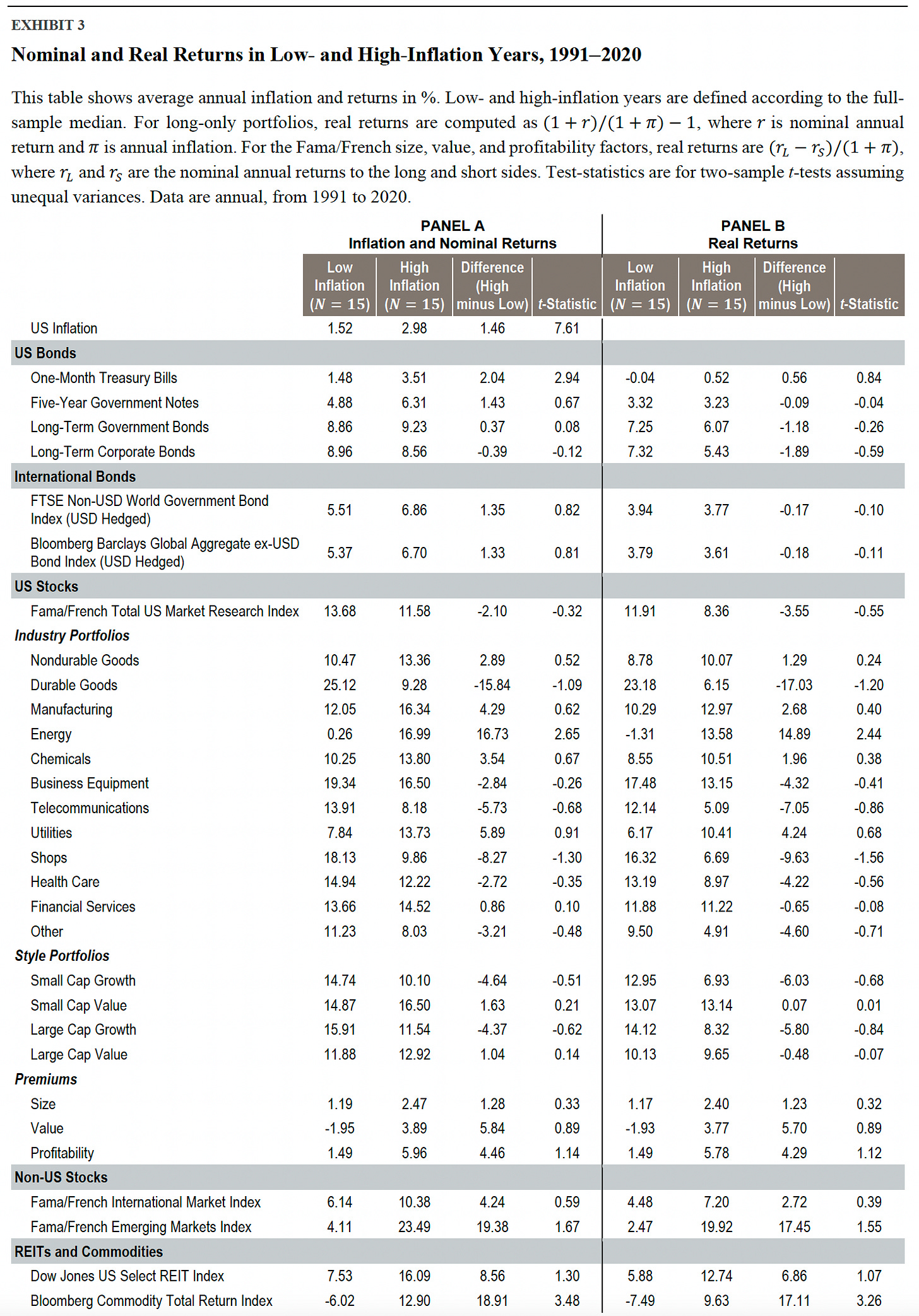

In Exhibits 2 and 3, inflation and nominal returns are shown in PANEL A, real returns (e.g. after inflation) are shown in PANEL B.

First, let’s consider Exhibit 2.

In this 94-year exhibit, notice the wide swing between average inflation in low-inflation years (0.47%) and high-inflation years (5.49%), or a swing of some 5.02%.

Across this period, it can be seen that all asset classes produced positive nominal returns, in both low- and high-inflation years. Interestingly, in Panel B, we see that, with the exception of T-bills, all asset classes produced positive real returns, even in high-inflation years.

Now, for Exhibit 3.

In this more recent exhibit, the swings low- and high-inflation years narrowed considerably, with low-inflation years coming in at 1.52% and high-inflation years at 2.98%.

Interestingly, over this period, energy stocks and commodities actually had negative real returns in low-inflation years, although generating solid real returns in high-inflation years.

These results might seem promising for investors looking to hedge against inflation using something other than TIPS. Here, though, the authors offer a caution. They note that energy stocks and commodities have been far more volatile than inflation. As an example, over the 30-year period from 1991-2020, the standard deviation of inflation was 0.90% while the standard deviations of the nominal returns of energy stocks and commodities were almost 20 times as large, at 19.02% and 17.52%, respectively.

For Advanced Readers

For any who are interested, there is an additional section to the study where the authors go the next step to break things down even further, by parsing out expected and unexpected inflation. They do so by molding inflation as an autoregressive process with one lag, which they estimate using rolling 20-year windows.

For the sake of keeping this article brief, I will not include this second level of depth here. However, for any readers interested in examining this section, here is a second, convenient link to the full study.

Briefly, though, here are the takeaways from that further analysis.

T-bills offer what the authors refer to as “comovement” with inflation; that is, they offer a measure of protection against unexpected inflation. However, as can be seen from Exhibits 2 & 3, T-bills on average delivered low returns that barely kept up with inflation.

The same comment presented earlier with respect to energy and commodity stocks appears to still hold true. Namely, while there is some truth to the the intuition that these are “inflation sensitive,” the comments as to volatility must still be considered.

Summary and Conclusion

First of all, the good news from the study is that, for investors with a long time horizon, maintaining a prudent weighting to asset classes that have historically provided position real returns, e.g. equities, should continue to serve you well.

For those seeking to hedge against inflation over the shorter term, inflation-indexed securities such as TIPS appear to be the most effective choice.

Having said that, however, this hedging is not free, it comes with a cost. Namely, the inflation risk premium inherent in TIPS, demanded by investors for the protection they offer against unexpected inflation.

A Note of Thanks

I wish to gratefully acknowledge the influence of Larry Swedroe in my investing life. It was an article of his that initially led me to the study featured in this article.

For readers interested in successful retirement planning, I also highly recommend his book Your Complete Guide to a Successful and Secure Retirement. Click on that link to check it out further, on Amazon.

I have been working on incorporating concepts from the book into my own retirement strategy. I hope to return with future articles explaining some of the steps I am working on implementing.

For now, if you haven’t already seen it, you might want to check out my article on a tax-advantaged triple threat you may wish to incorporate in your planning.

Until next time, I wish you . . .

Successful investing!!