On May 15, just shy of a month ago, I wrote the below post based on a recent note from Credit Suisse Investment Strategist Zoltan Pozsar.

Following the rather noteworthy events of the past two weeks, I felt a quick follow-up was in order, to give everyone a glimpse of where we stand now in relation to some of the items mentioned.

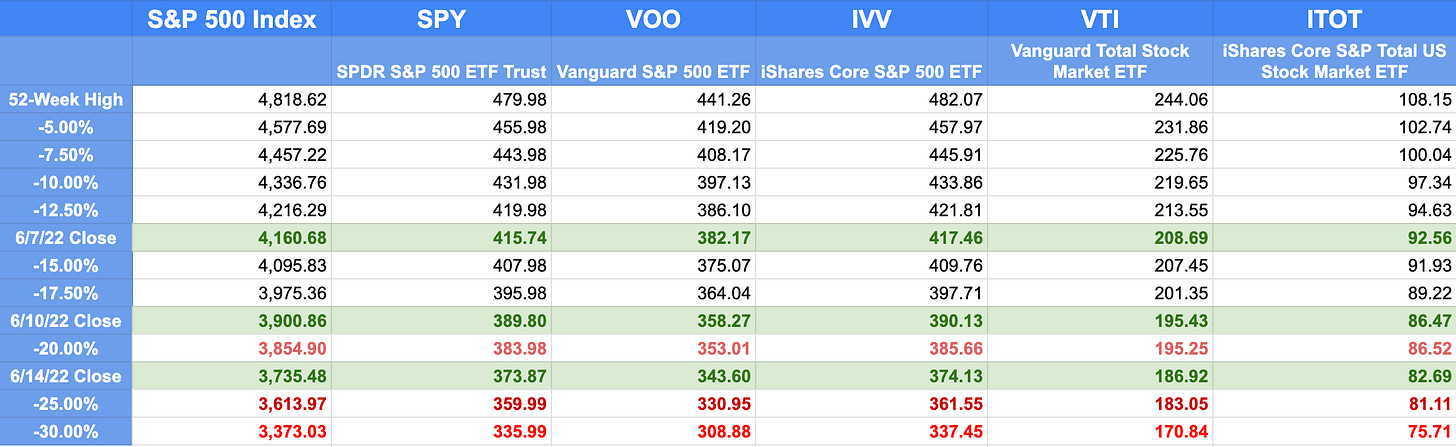

First, as of yesterday, June 13, the S&P 500 closed at 3,749.63, officially in bear territory based on the January 4, 2022 closing mark of 4,804.51. As I write this the evening of June 14, the index dropped once again, closing at 3,735.48.

I’ll have a follow-up article published tomorrow on Seeking Alpha, for whom I also write. In the article, I will include a little graphic tracking the recent history of the S&P index, as well as values for 5 ETFs that investors might be interested in following, with an idea to possibly setting predetermined good-till-canceled (GTC) limit buy orders at certain points. The article is far lengthier and detailed than this one, and covers quite a bit of additional ground. If you’re interested, feel free to head over there tomorrow and hunt it down. I’d also be happy to add a link in the comment section below if anyone is interested.

However, for my readers here, I thought I would also share just the graphic, with one handy addition. In the version below, I just added a row for today’s close with all the related information.

In the graphic, the first column in the top row displays the 52-week high for the S&P index. Moving down the column, it displays the value assuming a 5% decline, 7.5% decline, 10% decline, and so forth.

Moving to the right, the same is displayed for 5 ETFs. Three of these (SPY, VOO, and IVV) are ETFs that specifically track the S&P 500 index. The last two (VTI and ITOT) are total-U.S. market ETFs.

In addition to specific percentage points, you will see 3 rows in green. These represent the closing prices as of June 7—just one week ago—June 10, and today. I’d encourage you to pause for just a second and look at the scope of damage wrought in just the past week. It is over a 10% drop, in each case.

Where, though, do we go from here? In my personal comments in a follow-up to the initial Pozsar piece, I opined as follows:

My takeaway is that the next key area I am watching for is right around 3,500-3,600. At 3,600, you have a 25% decline in the S&P.

At about 3,400, we would be back to the levels immediately preceding the COVID-19 panic in late-February, 2020.

Far lower, at roughly 2,400-2,500, we would be at the December, 2018 mini-crash.

Looking back at the graphic above, the 3,600 - 3,400 range I mention just happens to equate to roughly a 25% - 30% drop on the S&P.

Interestingly, I am not the only one mulling over the 3,400 level as a possible “tradable low.”

With that in mind, hopefully my graphic can be of use to you.

Here’s an example, randomly selecting Vanguard S&P 500 ETF (VOO) as my ETF of choice. If you would be happy to add a certain $ amount if the S&P index drops 25%, roughly equivalent to the 3,600 level, you would set your GTC limit buy order at $330.95. You could also set a (possibly larger) automatic purchase at $308.88, roughly representing that “tradable low” of 3,400.

How large should your purchase be? You could look at this from a variety of vantage points. Here would be my suggestion. Base it on an asset allocation with which you are comfortable, and size your purchases accordingly. For example, if your stock allocation is 50% and all you want to do is rebalance to keep it there, plan your purchases that way. On the other hand, if you would be happy increasing your weighting to 52.5% at the 3,600 level, and 55% at the 3,400 level, clearly your purchases would be larger.

Keep in mind that all of the above examples are oversimplified. I didn’t get into whether you would like to split your stock allocation between U.S. and foreign, for example. And my suggested allocations are completely arbitrary. Depending on your personal circumstances, yours may be much different. But I think you get the basic idea.

OK, that’s it for today. I hope this piece finds everyone well, and not too badly hurt by the recent downswing.

As always, I would love to hear your comments and/or questions in the comments section below.

For any who may be interested, here’s a link to the Seeking Alpha article published today that I referenced in the article above.

https://seekingalpha.com/article/4518370-spy-etf-more-pain-likely-ahead